Our Leg Up was created to solve two huge problems in the property market:

1. To help people with a low deposit home loan (e.g., 5%) get their first home sooner;

2. To help you make money while you sleep using the part of your home you own.

This document is to explain how you can get a return on your own home.

How It Works

Your home is an asset. Usually, the biggest asset you have.

But there’s one big problem with it. Until now you couldn’t use the part of the home that you own to generate investment income.

Now you can. Let me explain.

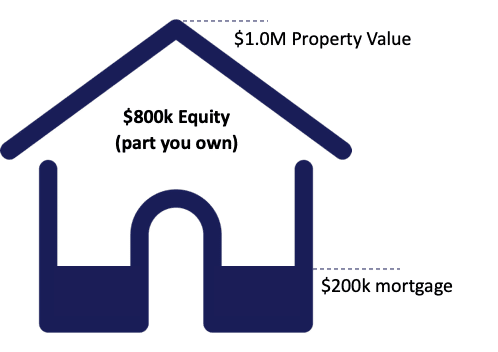

Your home is made up of two parts. The market value of it and any debts you have against it (usually a mortgage).

If you take the value of your home and subtract any debt you have a number. This number is known as your equity. In simple terms what you currently own.

For example, if you home is valued at $1,000,000 and you have a $200,000 mortgage your equity is the difference between the two.

So, you take $200,000 out of the $1,000,000 and are left with $800,000 of equity.

What Can You Do With Your Equity?

Right now, the equity in your home is like hiding cash under your bed. You do not get any return on it. You only do when you sell the house, but for most people that’s years away.

Wouldn’t it be better if you could invest your equity and make money while you sleep? You will get a decent return paid back to you on it today.

Our Leg Up has an investment vehicle that allows you to do just that.

In fact, you can invest up to 80% of your property value.

In our example 80% of the value is $800,000. You then take the $200,000 debt out and are left with $600,000 you can invest.

So instead of getting no investment income from your home you can now get an investment income on the $600,000.

What Is Done With My Equity?

This is a great question. Your equity is pooled with other investors and then offered to people wanting to buy their first home.

These buyers get a great interest rate and can avoid having to pay expensive fees normally needed to protect the big banks.

HOW DO I MAKE MONEY WHILE I SLEEP?

| $600k Equity Investment | Base Return (%) | Return p.a. ($) | 5yr Return ($) |

| Our Leg Up Income (cash) | 4.0% | 24.0k | 120.0k |

Based on current rates your $600,000 investment can generate:

– 1 year cash return of $24,000.

– 5 year cash return of $120,000.

Your return will depend on how much equity you have in your home and the rates of return when you invest.

That’s $120,000 you would never be able to get without this investment vehicle.

What are The Risks?

Sophisticated investors know investing is always a trade-off between risk and return.

We have taken every possible step to reduce the risks to some of the lowest of any investment vehicle.

You already know that property is one of the most stable assets over a long period of time and that is unlikely to change.

Before you commit to this, we give you a complete explanation of all the rules and risks in plain English.

You can then make an informed decision about whether this is right for you.

There’s never any pressure from us. There are more investors available than we can have demand for.

How Do I Get Into This?

In the future this will be widely available but right now it’s only available to sophisticated investors.

You are a sophisticated investor if you:

- Have a property worth at least $2.5 million OR

- Have annual pre-tax income of $250k+

Also, you must have your own home or investment property. You can use the equity in both your own home and your investment property as an investment.

Your next step is to request a FREE Investment Calculation.

To do this you simply send us your current property address(es) and the value of any debt on the property.

We will calculate your equity and show you what return you can receive.

If you like the numbers and details, then we’ll chat about arranging priority access into the next round of investments.

Leave a Reply