Unless you have a time machine there really is no point comparing your struggles with past generations. The truth is, each generation had/has their own difficulties. The real question you should be asking is, “Am I going to be better off in 5 years?”

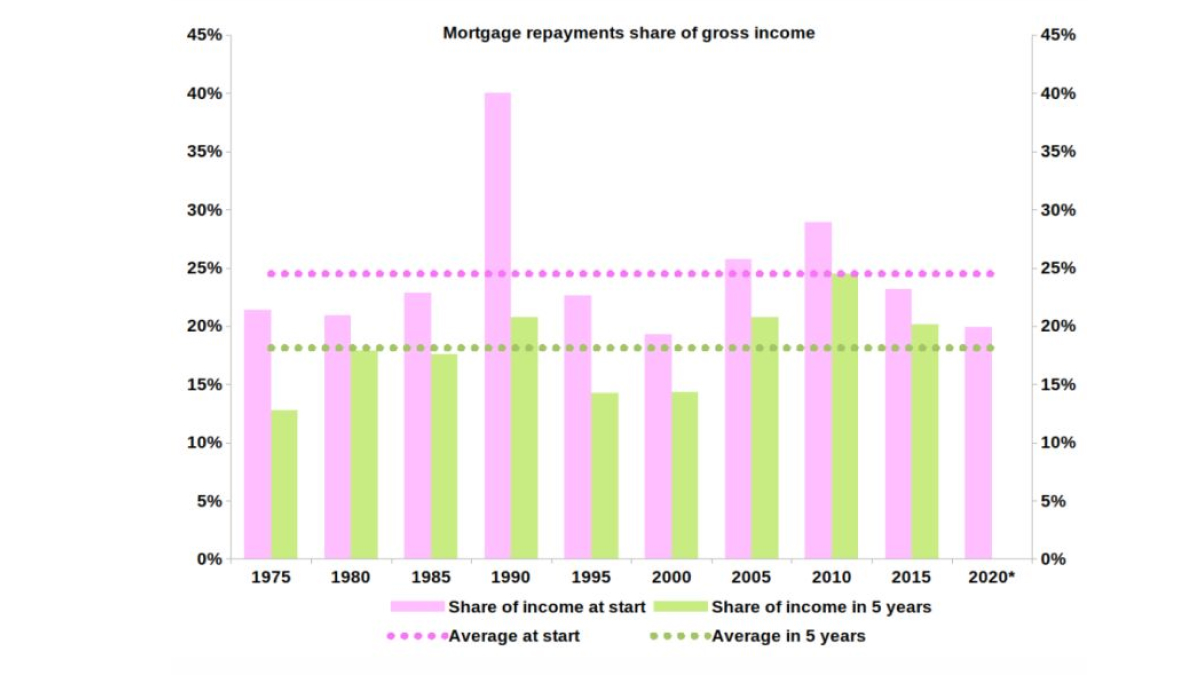

It is worth examining the past to see for each 5 year period going back to 1975, were those generations better off in 5 years and by how much?

In this analysis, time periods have been chosen on purpose at the exact 5 year intervals, every 5 years since 1975, so 1975, 1980,…2015, 2020. This is to avoid ‘cherry picking’ the data.

Incomes have been assumed to be a couple, (1 male and 1 female) working full time and earning average wages (gender pay gap included). Interest rates have been averaged across the year, prior to 1990 they were often consistent throughout the year.

For consistency, every year of calculations, couples borrowed 95% of the median Australian property price, as the average of 7 capital cities. Note, this would not have been easy or perhaps possible before 1983 (financial deregulation). Interest repayments are calculated based on the interest rate at that time assuming you are on variable rates.

The analysis shows 3 things:

1. Yes, some time periods had things better or worse than others (again not relevant without a time machine)

2. Every time period showed improvement after 5 years

3. Things are less uncertain after 5 years

Whether it is a good time to buy often relates more to your own personal circumstances though there are times when people are unlucky. The important thing to know is, things improve with time, even for unlucky people. Visit Our Leg Up to learn more

Leave a Reply