Understanding Liquidity

Put simply, the term ‘liquidity’ refers to the ability to raise funds or convert assets into cash in order to meet bills as they become due.

To reduce the risk of everyone withdrawing their funds at once, banks have a range of deposit accounts. These include different types of accounts.

- ‘Term deposit’ (deposits locked in for a ‘term’)

- ‘Bonus savers’ (extra interest to deposit cash in the account)

- ‘Offset accounts’ (attached to loans which reduce our interest)

The aim is to only have a few customers make a withdrawal at any one time.

In an emergency, the reserve bank can also offer liquidity funding as a backstop. ‘the lender of last resort’.

Houses are very illiquid and require us to pay money to the government each year for the privilege of living in our own home or pay a fee to a lawyer and most likely a commission to a realtor in order to be able to sell.

So how do we make property generate cash? It is this huge asset that we know is worth a lot but doesn’t pay for our groceries.

Insufficient liquidity: when things fail

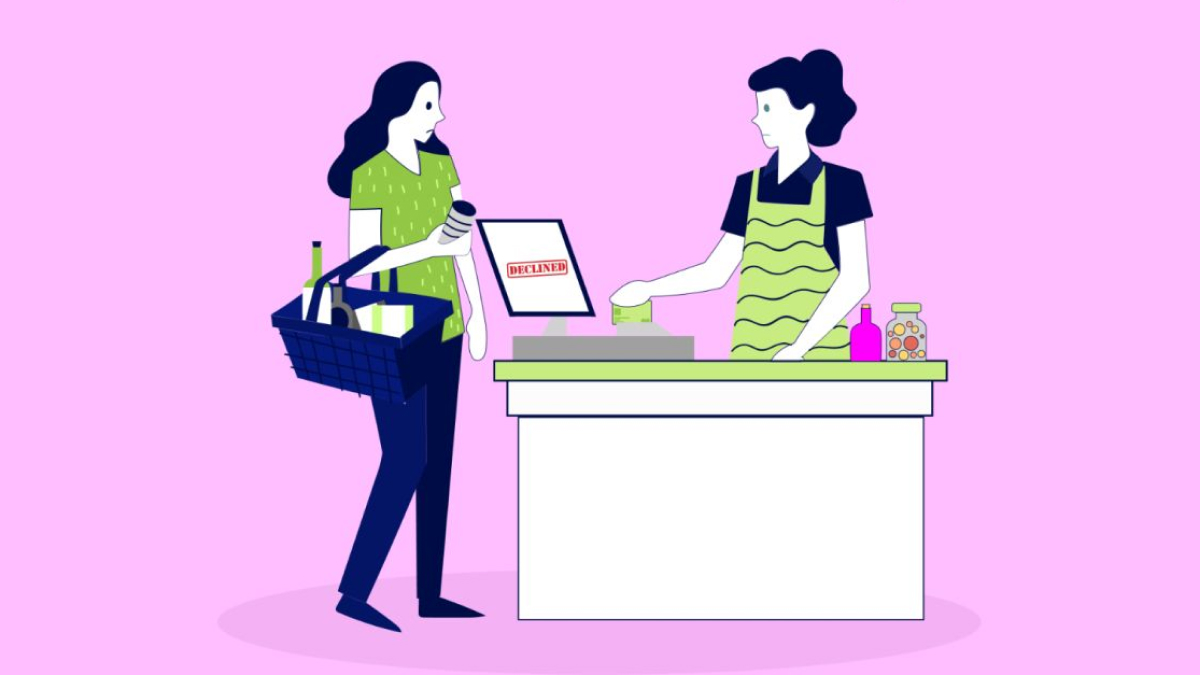

Have you ever reached the front of the supermarket queue with a week’s worth of groceries, only for your card to get declined? Imagine being a bank facing a week’s worth of customer withdrawals at the checkout, only to decline them.

When our card fails, embarrassment strikes, and we assure the store we thought we had funds, blaming the technology for failing. Frustration mounts, and we often call our partner or family to commiserate.

The recent US bank failures stem from banks holding assets they couldn’t liquidate in time to fulfill current withdrawal demands. The official cause? “Insufficient liquidity.”

Your Most Valuable Asset

Our Leg Up helps make property, often our most valuable asset, generate some cash. Or in banking speak, ‘improve asset liquidity’, without needing to take out an interest bearing loan. You no longer have to choose which of your children get’s the most financial support.

That said, Our Leg Up cannot transform your home into a deposit account. At its core, it is still a large illiquid asset. However, Our Leg Up has created a method to earn income from your home equity without the need to invest cash or rent out your property.

Typically, you should only opt for an OLU equity investment using your home’s equity if you plan to stay for at least three years.

Bank failures affect many, including those who are not bank customers. We must extract lessons wherever possible. It’s crucial that customers understand their investment terms. Some investments aren’t immediately accessible; we should anticipate a wait for returns. When you have a cash account for groceries, you expect your bank to avoid any “declined” messages at the checkout.

Visit Our Leg Up to find out more

Leave a Reply