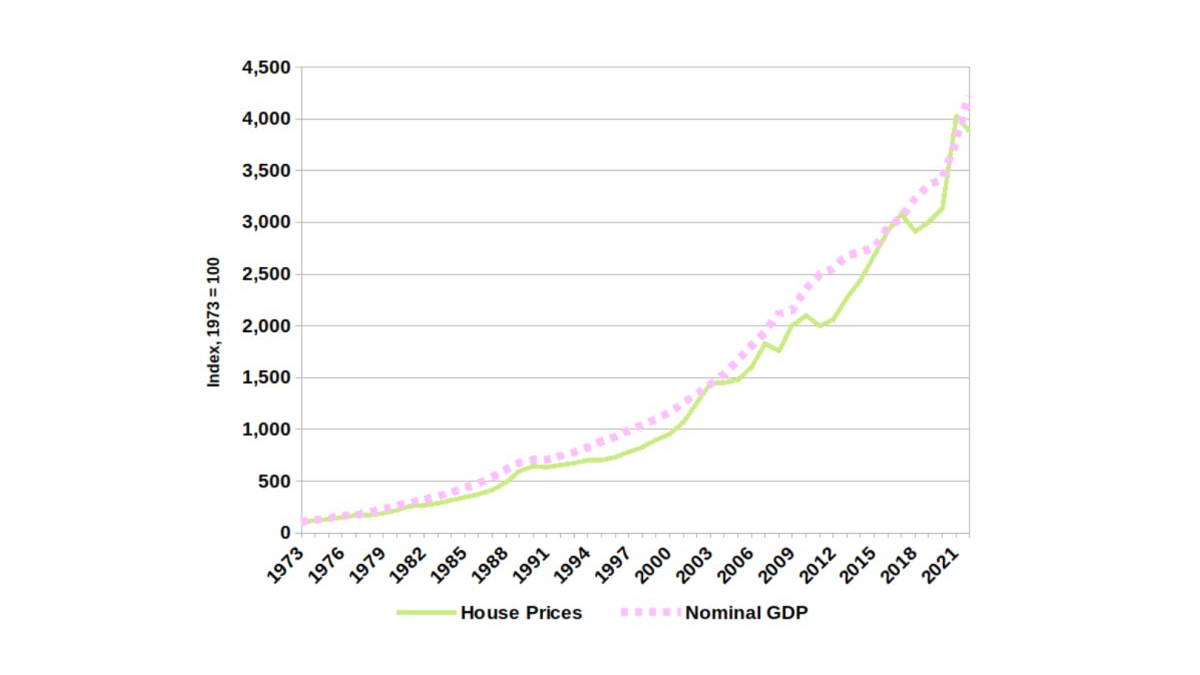

Do house prices grow faster than wages? The short answer is yes. Over the long term, history shows house prices tend to follow nominal GDP (as shown in the chart) which grows faster than income.

What is nominal GDP? Well it is the total production/income of all households. This includes the growth in the number of people/households as well as the growth in the amount of income they earn in the prices of that year (current prices). This shows house prices have traditionally benefited from population growth as well as wage and income growth from all sources.

Australia’s strong historic and projected population growth underpin the long run price growth greater than just the increases due to people’s wages. Nominal GDP has averaged 6.7% annually over the past 40 years since 1982. Both GDP and house prices are higher when inflation is higher. This growth rate excludes the very high inflation period of the 1970s.

The two series can at times deviate from one another. There is seemingly a gravitational pull that keeps them in line over time. If we examine the most recent 3 year cycle as a test of the relationship.

House prices shot up above the nominal GDP index. Once again, the two series adjusted. House prices fell in the year to Dec 2022, while in the latest year to December 2022, nominal GDP was up 12% as Australia benefited from higher prices of the commodities we sell and a return of migrants.

House prices can and do move up or down significant amounts in the short run but appear to maintain a strong relationship with nominal GDP over the long term to grow persistently faster than wages. Visit Our Leg Up to find out more

Leave a Reply