-

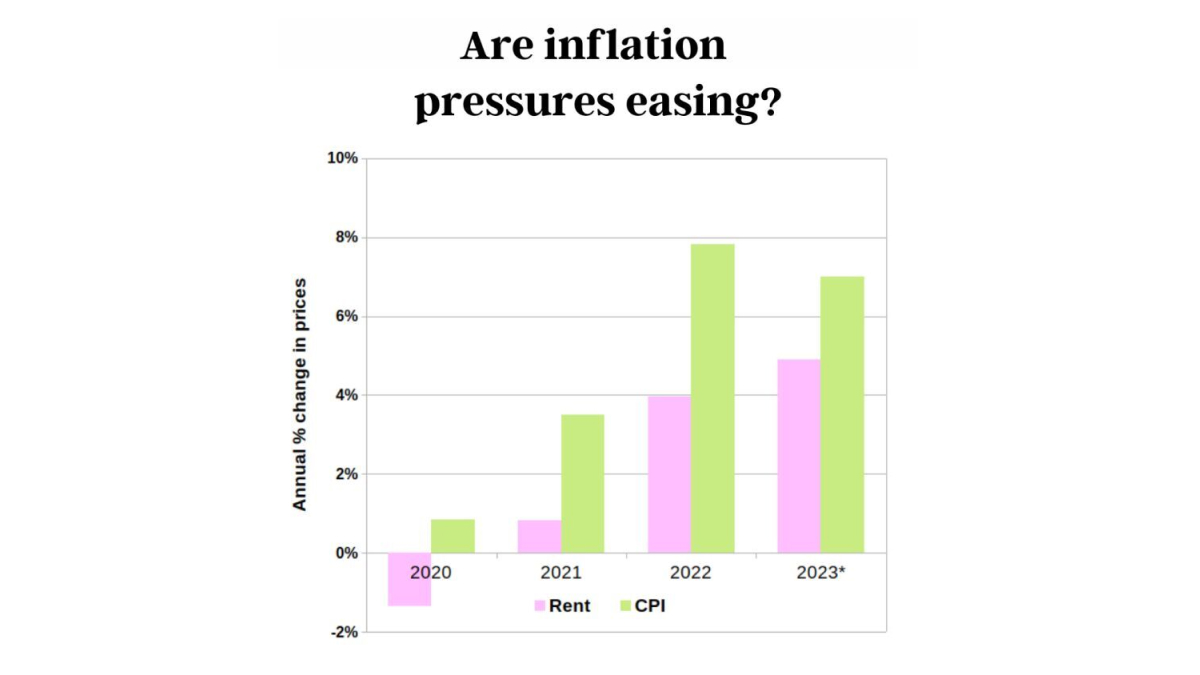

Is the inflation challenge really over?

Headline CPI came in at 7.0% which is a reduction of 0.8% from the December quarter reading of 7.8%. Does that mean the inflation challenge is over? Right across the world inflation got a huge shock after pandemic-era stimulus boosted demand simultaneously and global supply chains could not keep up. That catalyst is well and…

-

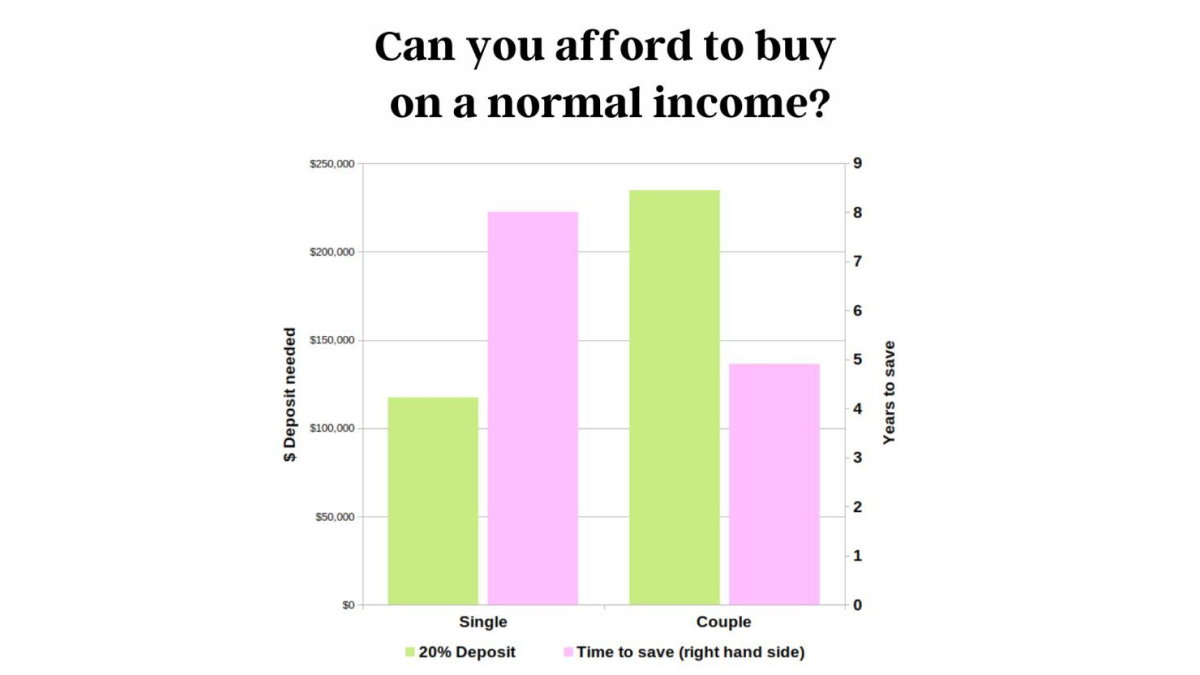

Can the average person afford a home?

There has been a lot of discussion around the fact younger people are needing more help from their parents. Is it even possible for a person on a normal income to afford a home? According to the ABS the average income for somebody employed full-time across both males and females and without any overtime or…

-

Analyzing the Ups and Downs of Rental Market: Are Rents Catching Up or Going Overboard

There is no doubt rents are under pressure. In a tight rental market, the struggle is real. The question is, are rents too high or are they just playing catch up? Looking at the change in advertised rent for 1 month, or 1 quarter can sometimes led you astray. There can be large movements when…

-

Can You Afford to Retire Your Way?

We all want a comfortable retirement. Has that been put out of reach? Newspapers were focused on the ‘positives’ in the latest CPI. Yay, CPI was only 6.8%, only 6.8%! If we are fortunate enough to afford those little luxuries, they are a lot more expensive. ‘Holiday travel and accommodation’ was up 14.9% in the…

-

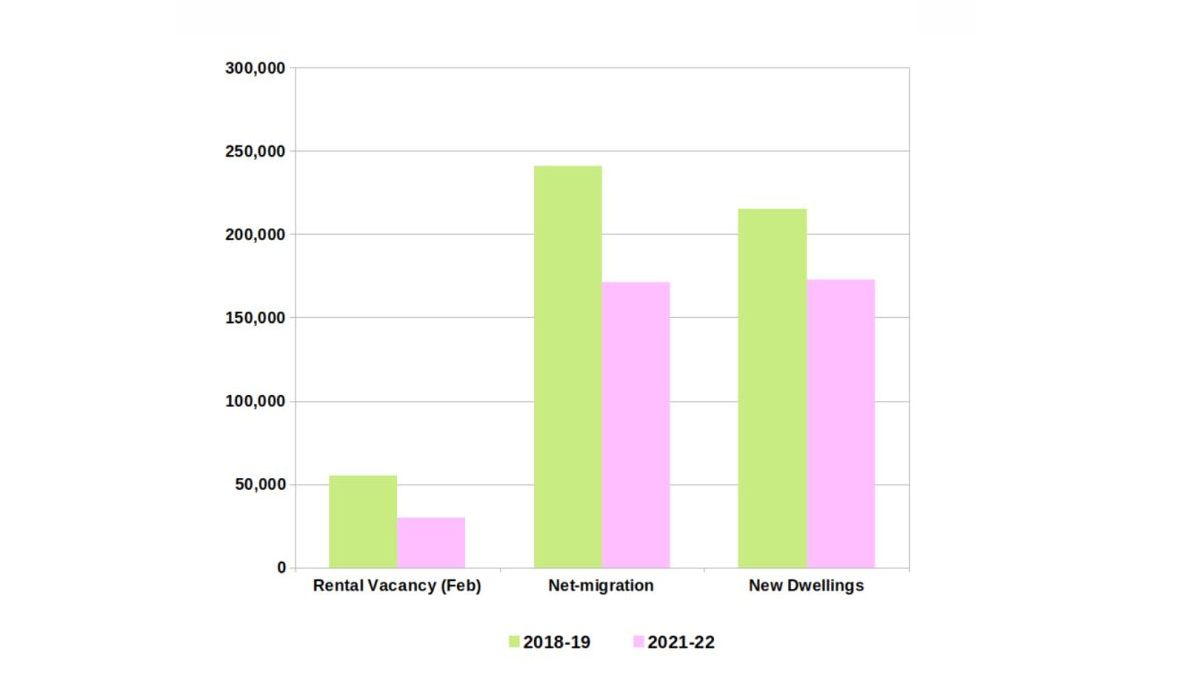

Rental vacancies hit a 15-year low, but blaming it all on student migrants is missing the bigger picture

Housing is tight, really tight. According to SQM Research, rental vacancies in February 2023 across major metropolitan areas have reached 1.0%, not seen since 2006. Commentators point to a ‘flood’ of student migrants re-entering Australia. This is an easy message to sell because we tend to think of the success of our universities and the…

-

Is Saving for a Deposit Getting Harder?

Interest rates are going up! Why is it getting harder to save? Putting together a deposit should be getting easier. Banks are desperate for our deposits but where are the amazing deals? Despite the highest official cash rates from the RBA since 2007, the national savings rate is falling. In the latest official figures from…

-

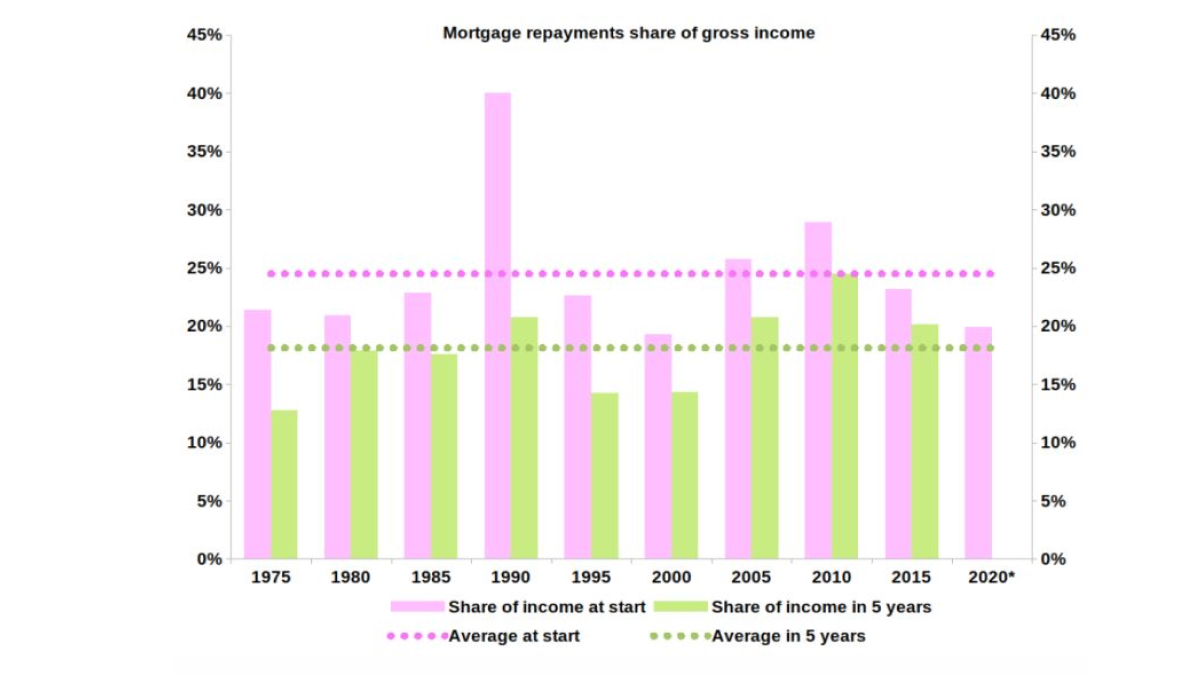

Analyzing Past Generations’ Financial Progress: Are You Going to be Better Off in 5 Years

Unless you have a time machine there really is no point comparing your struggles with past generations. The truth is, each generation had/has their own difficulties. The real question you should be asking is, “Am I going to be better off in 5 years?” It is worth examining the past to see for each 5…

-

Preparing for Opportunity: How Our Leg Up Can Help You Secure Your Dream Home with a 5% Deposit

Is the RBA about to fire the starter’s gun in a race to save? It’s been a white knuckle interest rate ride that most aspiring homeowners have never experienced before. Interest rates have grown faster than any time since the 1980s but could that be over soon? These are the words in which the RBA…

-

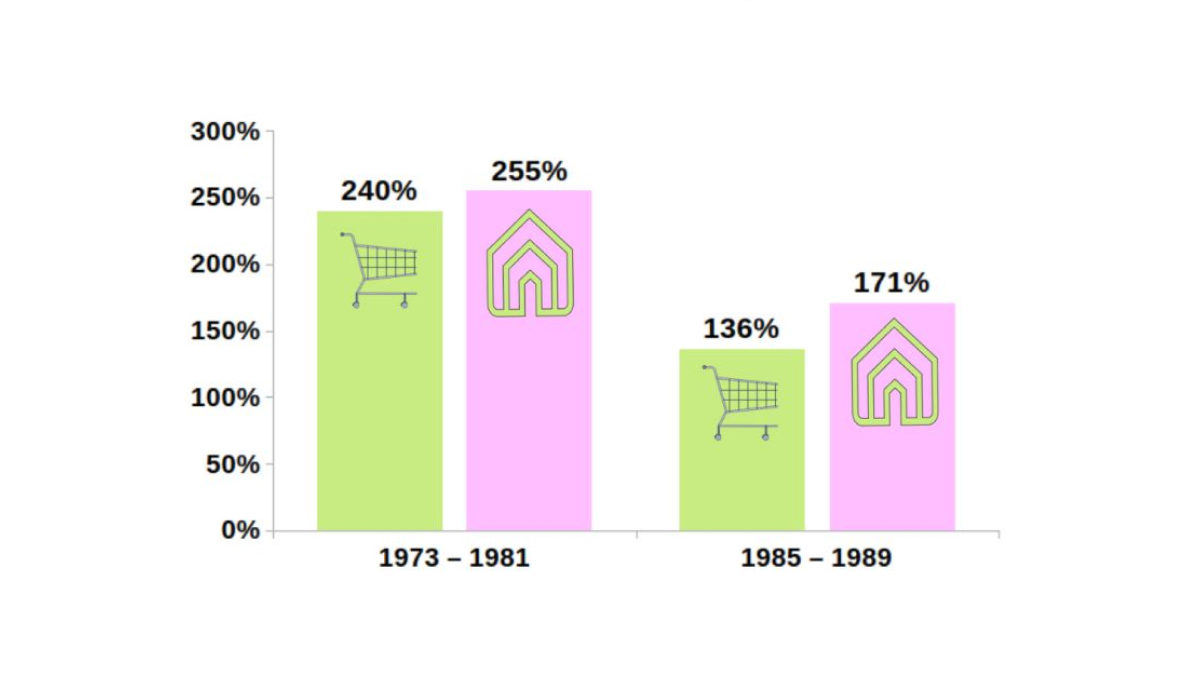

Analyzing the real change in Australian house prices over the last 50 years

Australian house prices have grown substantially since 1973. The 7 city combined Australian median house value was $21,400 in 1973. 50 years later, in February 2023 the same combined 7 city median house value has increased to $914,750. The nominal dollar value of housing has increased by approximately 43 times since 1973. Any analysis would…

-

Is your fixed interest rate about to expire? Don’t get caught out by potential rate hikes

The RBA has increased interest rates by 350 basis points (3.5%) despite its own minutes in February 2021 stating, “Members affirmed that the cash rate would be maintained at 10 basis points… will not increase the cash rate… The Board does not expect these conditions to be met until 2024 at the earliest.”. Many households…

-

Stop Getting Cooked by Unfair Home Loan Deals – Get the Best Rate with Our Leg Up Today!

Are you being cooked by your interest rate increasing faster than it should? Many banks sign new homeowners at competitive interest rates. They ‘lock in a discount for the life of the loan’ making it seem like you always have access to the best possible rate. Do you really? Slowly but surely, the standard variable…

-

Reduce Mortgage Stress with Our Leg Up – Get a Better Deal on Your Home Loan Repayments Today

Are your homeloan repayments rising as a share of your income? This is commonly referred to as mortgage stress. It is the biggest worry for many Australian households. Getting a better deal to lower your repayments is a way to stretch the budget further. There are a range of measures being used by banks to…

-

Why finding a house to rent is becoming increasingly difficult in Australia despite record building activity

There is a huge amount of building activity going on right now. ’Work done’ estimated by the ABS is near record levels. How come I still can’t find a house to rent? The ABS National Accounts for the growth in dwelling stock (excluding changes in prices), shows there is no housing boom. In fact in…

-

Take control of your future and secure your own home with Our Leg Up

Jim Chalmers latest suggestion is for super funds to respond to systemic risks around affordable housing. “If we fail to act… we will face the prospect of an economy that won’t sustain the growth that we need, and this will all be to the detriment of a good, dignified retirement for as many Australians as…

-

Are corporate rentals the answer to the rental crisis?

Company or investment vehicles which own multi-unit buildings are being touted as the next housing solution. They offer a secure tenancy for prospective tenants to remove the fear of being evicted out of signing a lease. This is a great option for those tenants who have suffered this fate, sometimes more than once. Companies also…

-

Is saving for a home more difficult now? It seems that way

Many young Australians choose to spend more years in education which delays the time before they can get their first job and buy their first home. Education debt is something we don’t think about until there is an unexpected hole in our pay. To our surprise, the government keeps up to 10% of every dollar…

-

Breaking the cycle of rental insecurity: Take a leg up towards your own home with our help

Australians are facing a new paradigm. Australians are better educated, earn more and have more flexible employment options than ever before. Despite this, getting and then keeping a secure rental is getting harder. Tenancy laws have been changed in many states in an attempt to provide renters with security. Sadly, tenants dread receiving a letter…

-

Navigating the Rental Crisis: How Our Leg Up Can Help You Save for a Deposit and Achieve Home Ownership

Rents in cities are beginning to lift at an alarming rate. The CoreLogic estimate increase in median rents for houses is 13.5% across the 5 major capital cities in the year to December 2022. Growth in the price of unit rents is even higher, 15% across the 5 major capital cities over the year. Will…

-

Will shared Equity get me Into a House Faster?

Using a shared equity schemes come with a catch. There are many different forms but most allow you to gain access to a home faster. It is not your home. Depending on the scheme, when you buy them out, they can take up to 75% of the increase of your home’s value. Watch out for…

-

Want to halve your chance of living in poverty?

Is the pension enough to live on? Do I have enough super? What if I get sick or suffer an accident? These are all the common questions people ask themselves. The most important question is often overlooked. Being a renter doubles your chances of living in poverty. According to ACOSS (Australian not for profit experts…