-

The Story Behind Our Name: Why We’re Called “Our Leg Up”

Have you ever wondered why we’re called “Our Leg Up”? It’s not just a catchy name—it’s a reflection of our mission to provide support and elevate individuals in their journey towards financial independence. Let’s clear up some common misconceptions and explore the meaning and inspiration behind Our Leg Up. The Origin of “Our Leg Up”…

-

How Our Leg Up Can Help Improve Your Asset Liquidity and Generate Income from Your Home Equity

Understanding Liquidity Put simply, the term ‘liquidity’ refers to the ability to raise funds or convert assets into cash in order to meet bills as they become due. To reduce the risk of everyone withdrawing their funds at once, banks have a range of deposit accounts. These include different types of accounts. The aim is…

-

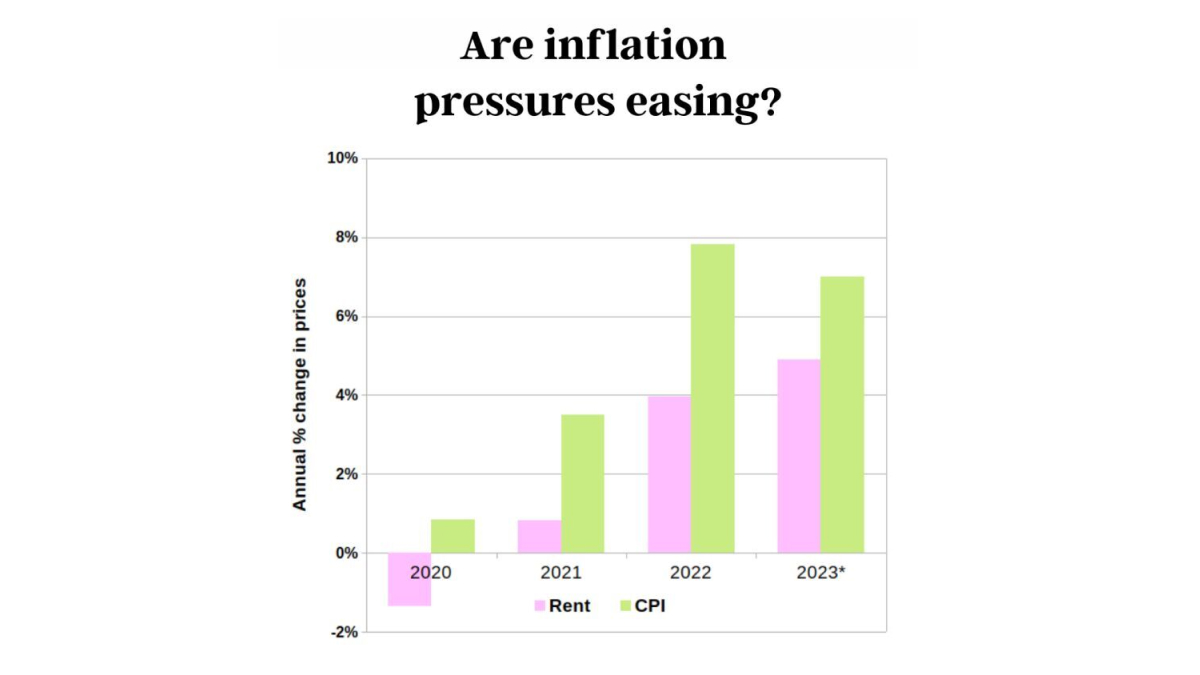

Is the inflation challenge really over?

Headline CPI came in at 7.0% which is a reduction of 0.8% from the December quarter reading of 7.8%. Does that mean the inflation challenge is over? Right across the world inflation got a huge shock after pandemic-era stimulus boosted demand simultaneously and global supply chains could not keep up. That catalyst is well and…

-

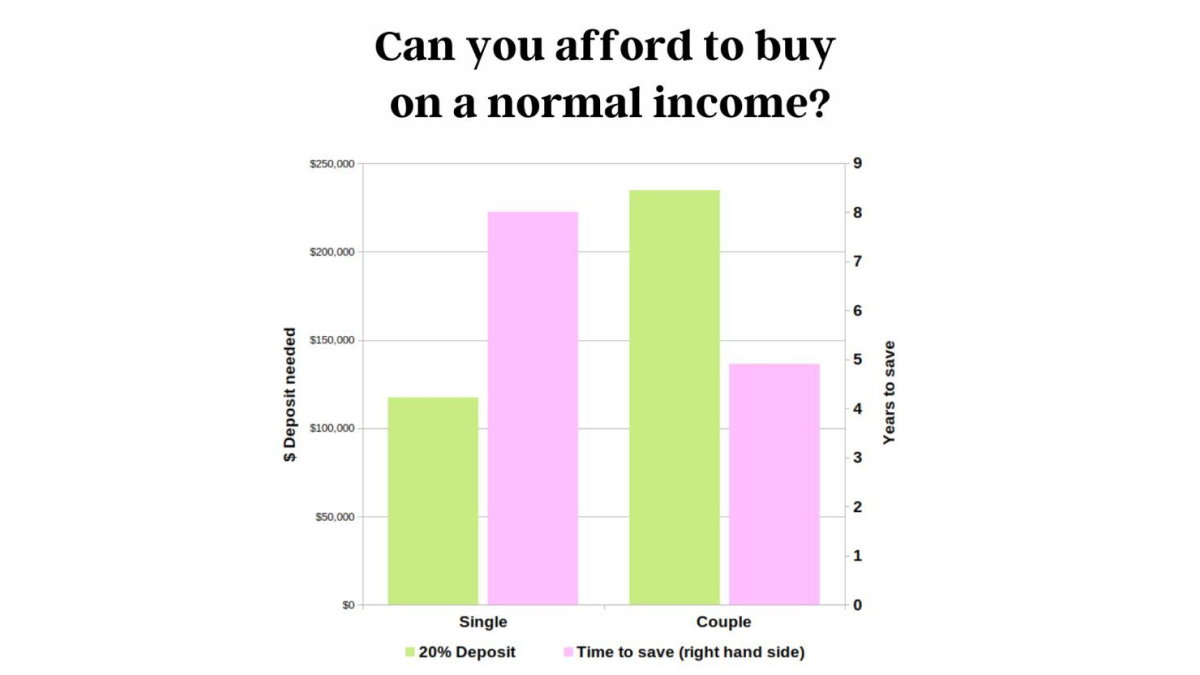

Can the average person afford a home?

There has been a lot of discussion around the fact younger people are needing more help from their parents. Is it even possible for a person on a normal income to afford a home? According to the ABS the average income for somebody employed full-time across both males and females and without any overtime or…

-

Are rents too high or just playing catch up? Analyzing the rental market in Australia

There is no doubt rents are under pressure. In a tight rental market, the struggle is real. The question is, are rents too high or are they just playing catch up? Looking at the change in advertised rent for 1 month, or 1 quarter can sometimes led you astray. There can be large movements when…

-

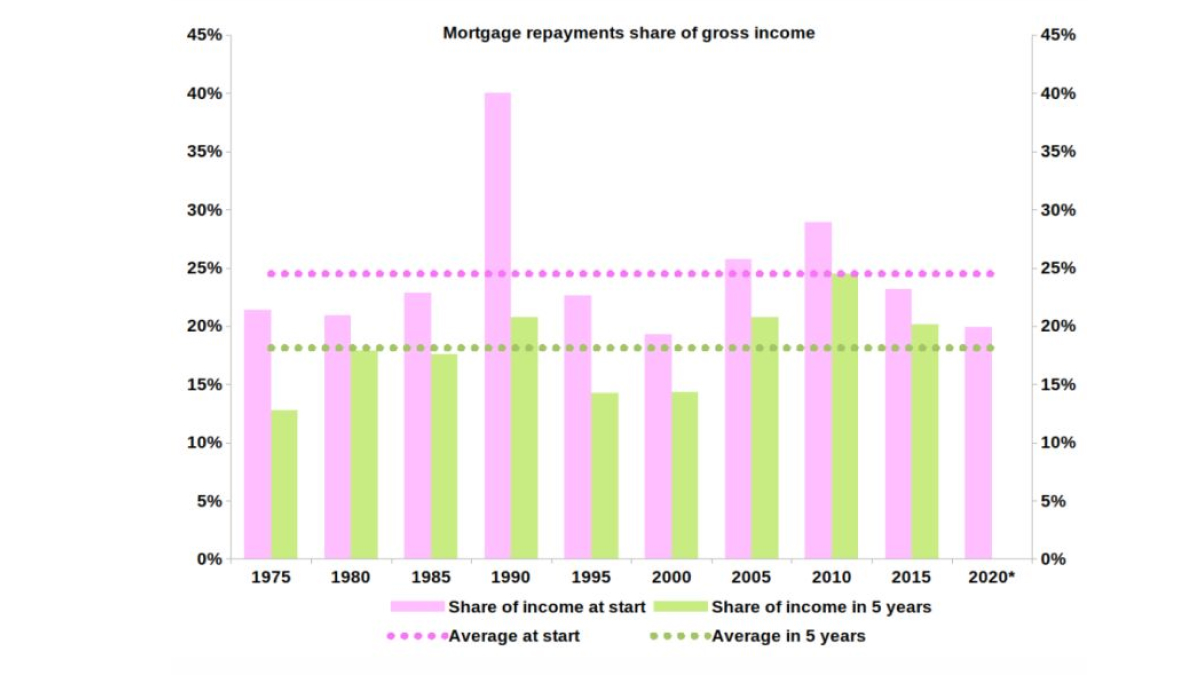

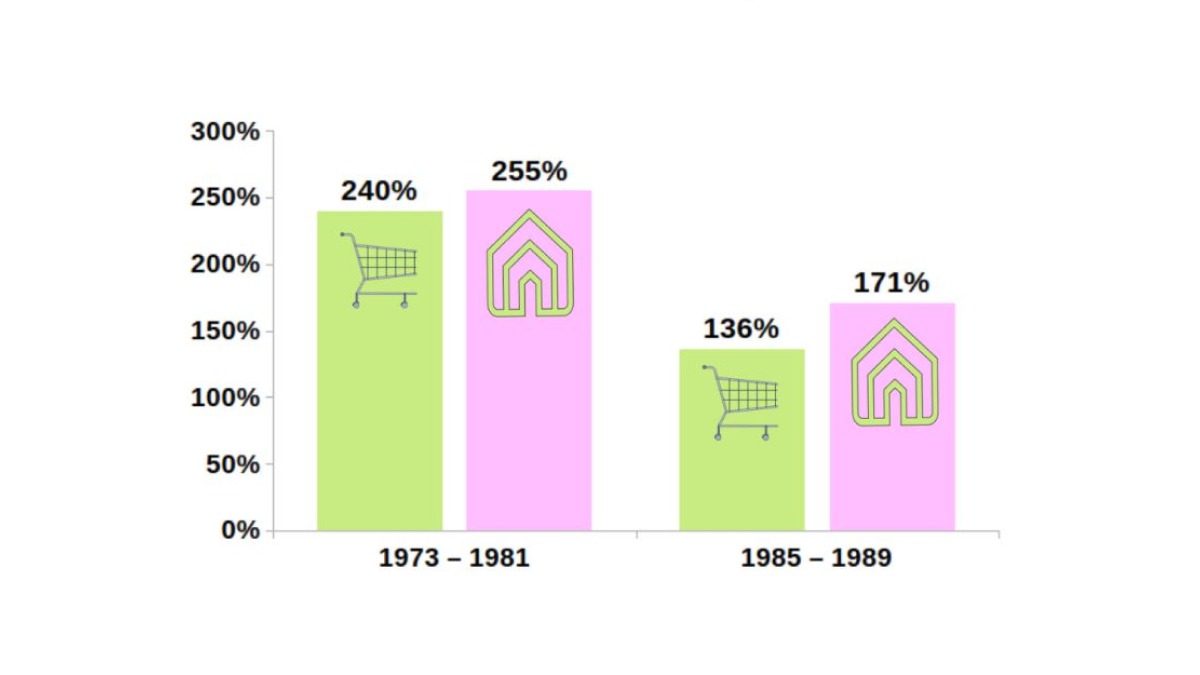

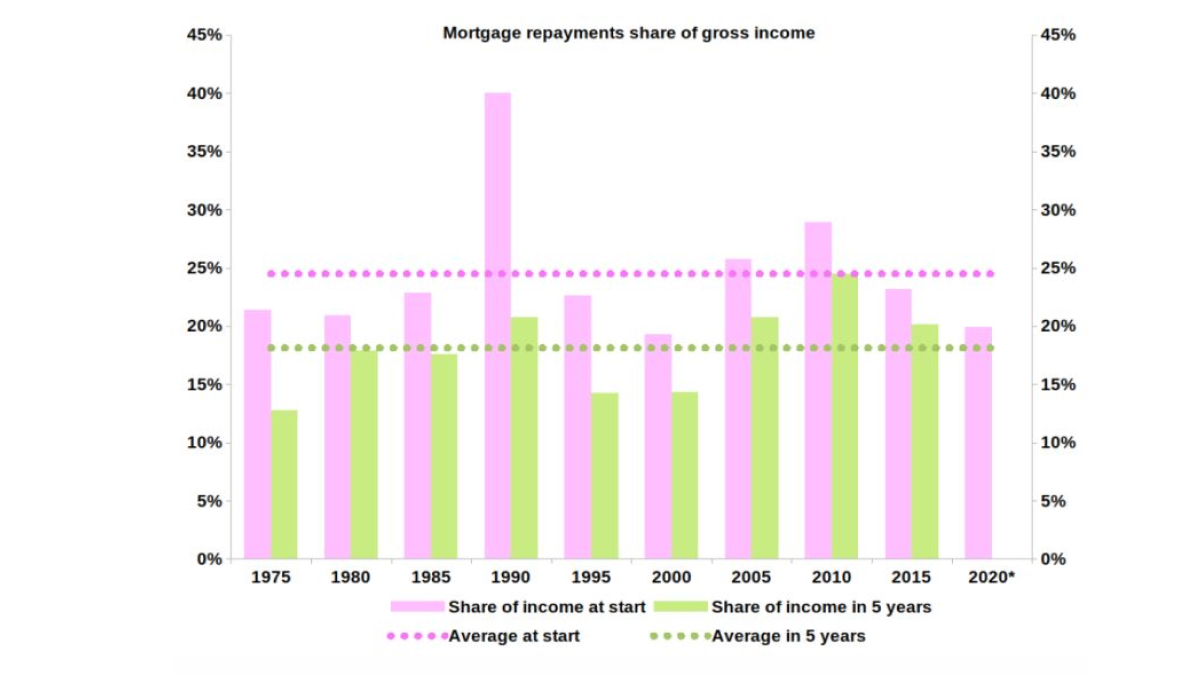

Examining the Past to See if You’ll Be Better Off in 5 Years – An Analysis of Australian Incomes and Property Prices Since 1975

Unless you have a time machine there really is no point comparing your struggles with past generations. The truth is, each generation had/has their own difficulties. The real question you should be asking is, “Am I going to be better off in 5 years?” It is worth examining the past to see for each 5…

-

Unlock the Hidden Income in Your Property Portfolio with Our Leg Up

The recent banking crisis is likely to further increase the interest rate on your property portfolio. Right now, the banks are sending a letter with an increase every month. In most states, regulations only allow you to increase the rent once a year so how do you keep up with the rising cost? If you…

-

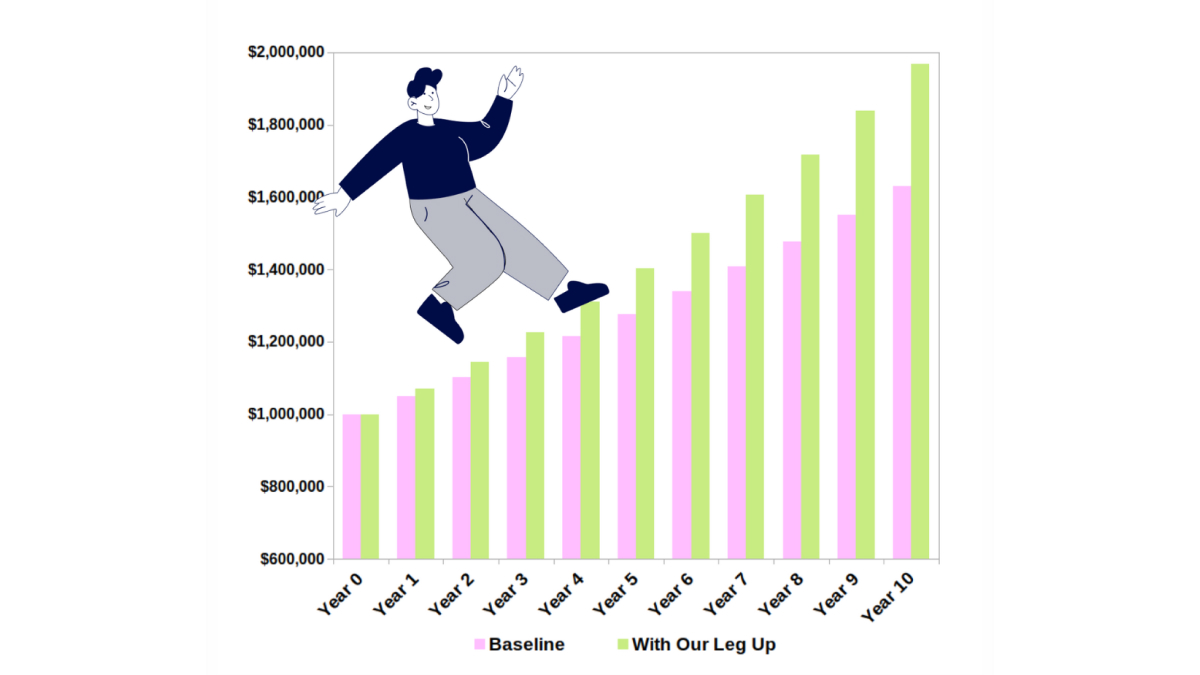

Unlock your home’s potential with Our Leg Up

Unlock the potential of your home with Our Leg Up and secure both financial security and the benefits of homeownership Owners in metropolitan cities across Australia have seen a significant boost in their assets over the past decade. Despite recent declines, Sydney house values remain above $1.2mil, Melbourne close to $900,000, with Brisbane, Adelaide and…

-

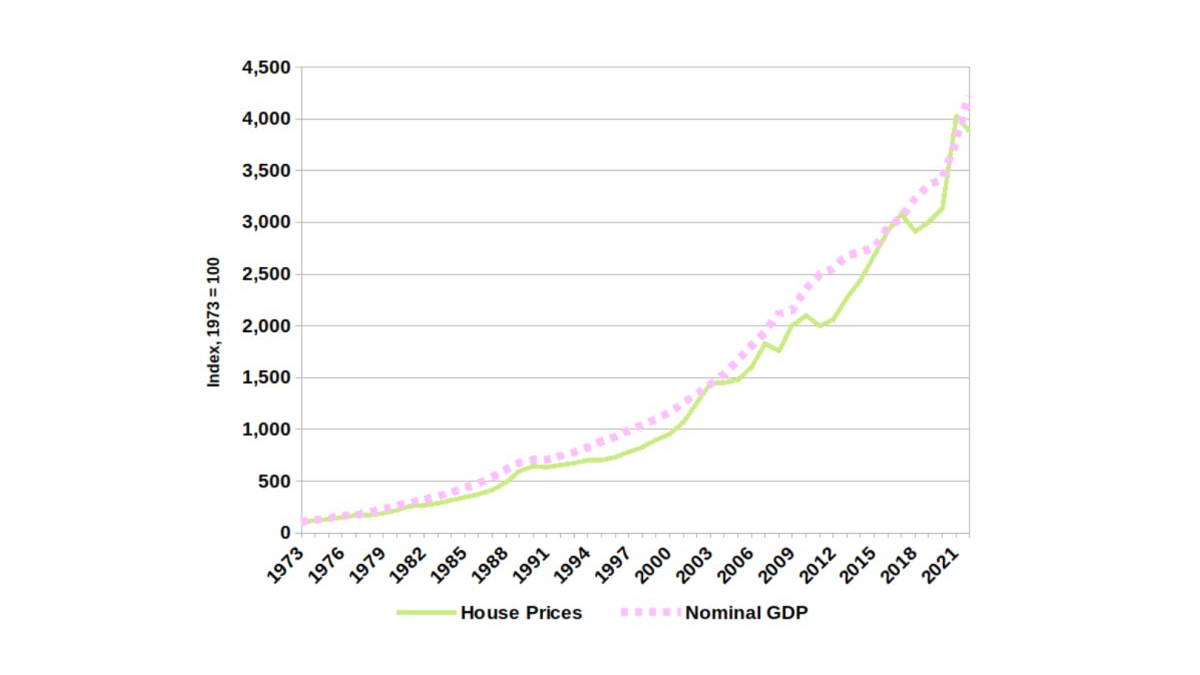

Analyzing the Real Change in Australian House Prices: Understanding Inflation’s Impact on Nominal Values Over the Last 50 Years

Australian house prices have grown substantially since 1973. The 7 city combined Australian median house value was $21,400 in 1973. 50 years later, in February 2023 the same combined 7 city median house value has increased to $914,750. The nominal dollar value of housing has increased by approximately 43 times since 1973. Any analysis would…

-

Want to boost your property investment returns?

Over the long run, the housing market has been a strong performer. It offers investors some clarity and comfort because they know what they own. It can also offer regular income (when rented) or offer a consumption of shelter (if live-in). Houses are also able to benefit from tax advantages if lived in, or a…

-

Understanding the relationship between house prices and wages

Do house prices grow faster than wages? The short answer is yes. Over the long term, history shows house prices tend to follow nominal GDP (as shown in the chart) which grows faster than income. What is nominal GDP? Well it is the total production/income of all households. This includes the growth in the number…

-

Retirees, don’t feel trapped by your own home!

Retirees tend to remain where they are most comfortable. Put simply, the longer you can hold onto your home, the greater certainty you will have over your retirement. It is no surprise that we are holding onto our homes longer than ever before. The average ‘hold period’ for all households rose nationally in the latest…

-

Analyzing the Ups and Downs of Rental Market: Are Rents Catching Up or Going Overboard

There is no doubt rents are under pressure. In a tight rental market, the struggle is real. The question is, are rents too high or are they just playing catch up? Looking at the change in advertised rent for 1 month, or 1 quarter can sometimes led you astray. There can be large movements when…

-

Can You Afford to Retire Your Way?

We all want a comfortable retirement. Has that been put out of reach? Newspapers were focused on the ‘positives’ in the latest CPI. Yay, CPI was only 6.8%, only 6.8%! If we are fortunate enough to afford those little luxuries, they are a lot more expensive. ‘Holiday travel and accommodation’ was up 14.9% in the…

-

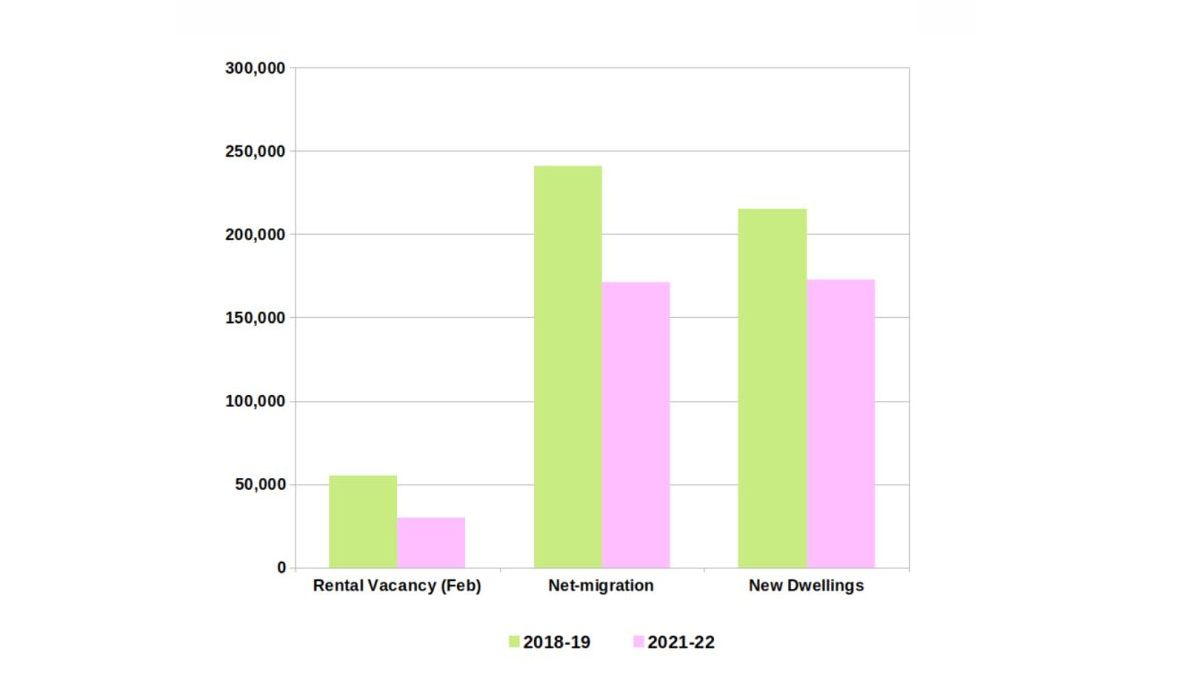

Rental vacancies hit a 15-year low, but blaming it all on student migrants is missing the bigger picture

Housing is tight, really tight. According to SQM Research, rental vacancies in February 2023 across major metropolitan areas have reached 1.0%, not seen since 2006. Commentators point to a ‘flood’ of student migrants re-entering Australia. This is an easy message to sell because we tend to think of the success of our universities and the…

-

Is Saving for a Deposit Getting Harder?

Interest rates are going up! Why is it getting harder to save? Putting together a deposit should be getting easier. Banks are desperate for our deposits but where are the amazing deals? Despite the highest official cash rates from the RBA since 2007, the national savings rate is falling. In the latest official figures from…

-

Ease the Squeeze: How Our Leg Up Can Help You Meet Rising Health Costs Without Incurring Debt

The recent NSW election result should see the end of the public service wage cap. By far the biggest cost will go toward nurses’ wages. Unfortunately removing the wage cap while overall hospital funding is capped will make the problem worse. The Federal Albanese government caps hospital funding at only 6.5% growth. Every 1% that…

-

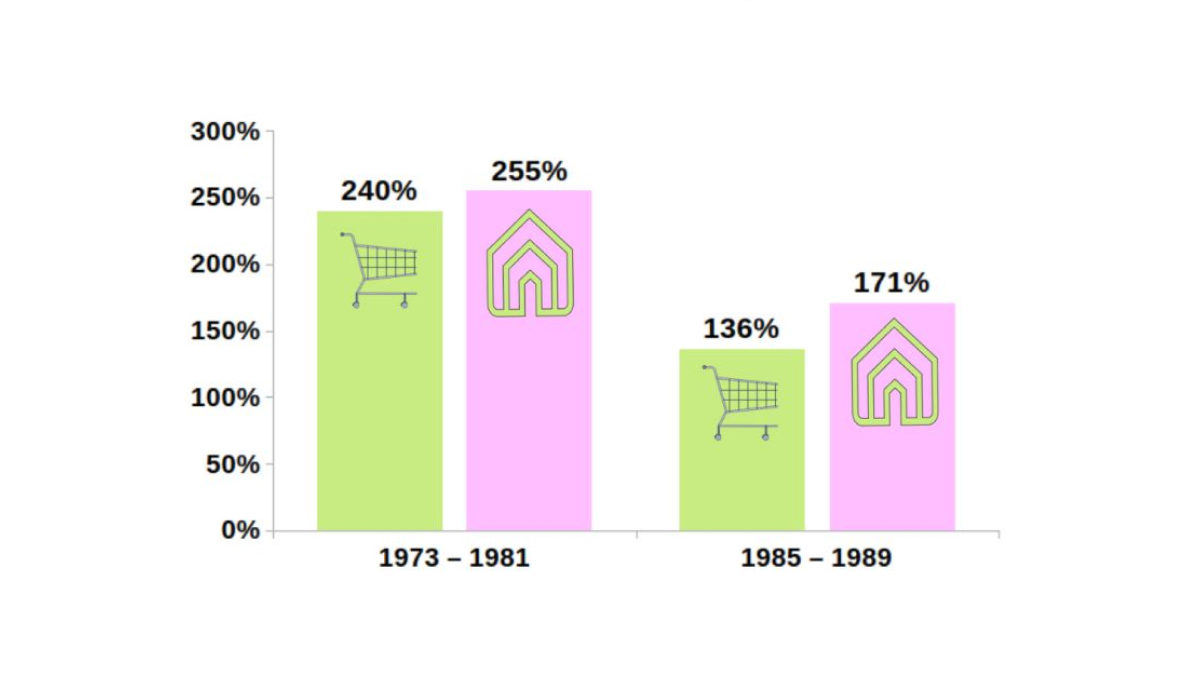

Analyzing Past Generations’ Financial Progress: Are You Going to be Better Off in 5 Years

Unless you have a time machine there really is no point comparing your struggles with past generations. The truth is, each generation had/has their own difficulties. The real question you should be asking is, “Am I going to be better off in 5 years?” It is worth examining the past to see for each 5…

-

Preparing for Opportunity: How Our Leg Up Can Help You Secure Your Dream Home with a 5% Deposit

Is the RBA about to fire the starter’s gun in a race to save? It’s been a white knuckle interest rate ride that most aspiring homeowners have never experienced before. Interest rates have grown faster than any time since the 1980s but could that be over soon? These are the words in which the RBA…

-

Managing Property Portfolio in a Rising Interest Rate Environment

The recent banking crisis is likely to further increase the interest rate on your property portfolio. Right now, the banks are sending a letter with an increase every month. In most states, regulations only allow you to increase the rent once a year so how do you keep up with the rising cost? If you…

-

Unlock the income potential of your property portfolio with Our Leg Up, without taking on more debt

Property is a great way to build wealth for wage and salary income earners. Many Australians have taken the opportunity to build their wealth this way, often with 2 or more properties. As interest rates have increased, banks are suddenly less willing to lend. They said no to the house! Many property investors have significant…

-

Learn about liquidity, how it affects banks, and how Our Leg Up can help property owners

Have you ever got to the front of the queue at the supermarket with a week full of groceries only to have your card declined? What if you were an entire bank with a week ‘worth of customers withdrawals’ waiting at the checkout, only to be declined? When our card fails, we get embarrassed and…

-

Analyzing the real change in Australian house prices over the last 50 years

Australian house prices have grown substantially since 1973. The 7 city combined Australian median house value was $21,400 in 1973. 50 years later, in February 2023 the same combined 7 city median house value has increased to $914,750. The nominal dollar value of housing has increased by approximately 43 times since 1973. Any analysis would…